走进杏彩·电子(中国)官方网站

Enter Twain精益求精 传承工匠精神

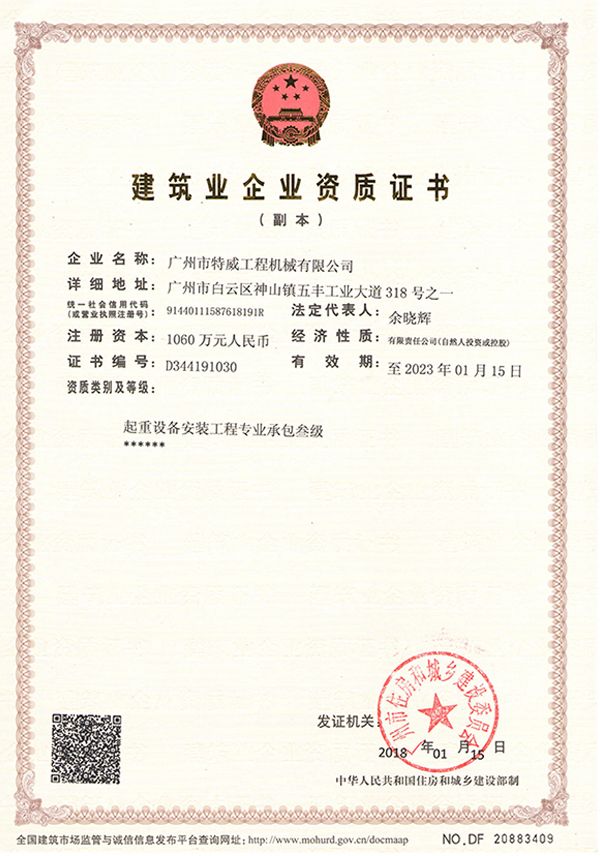

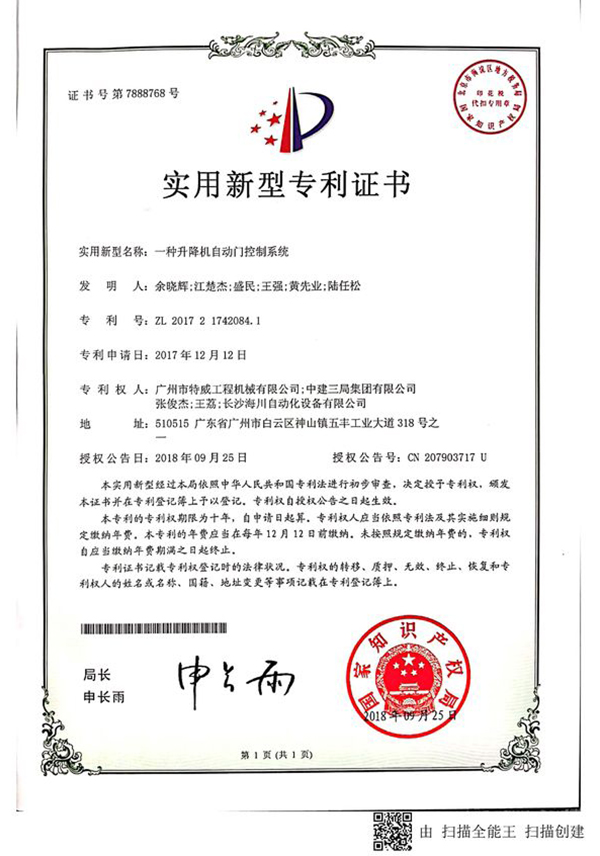

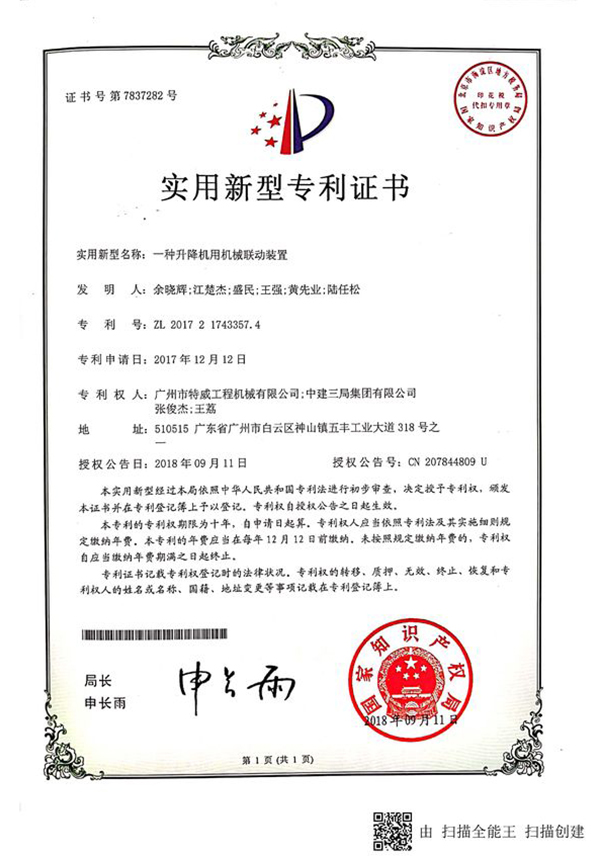

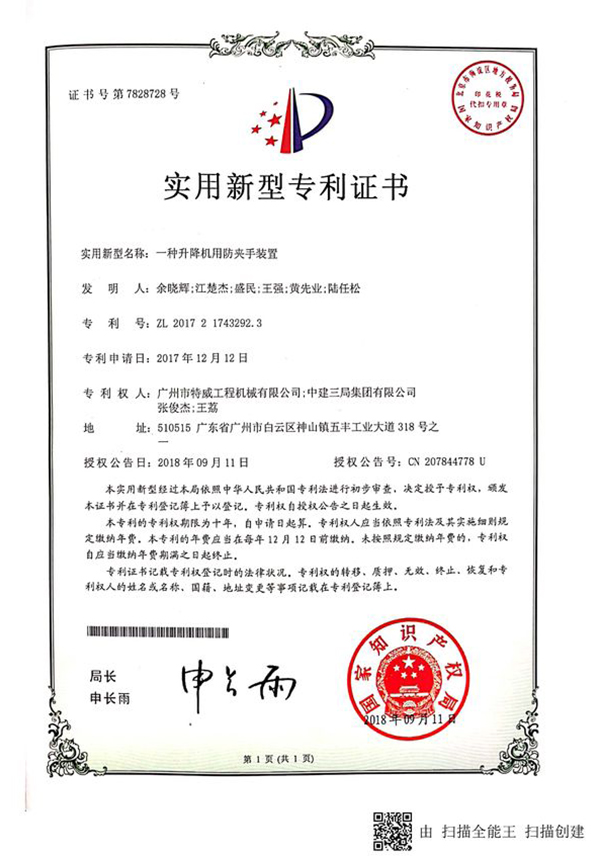

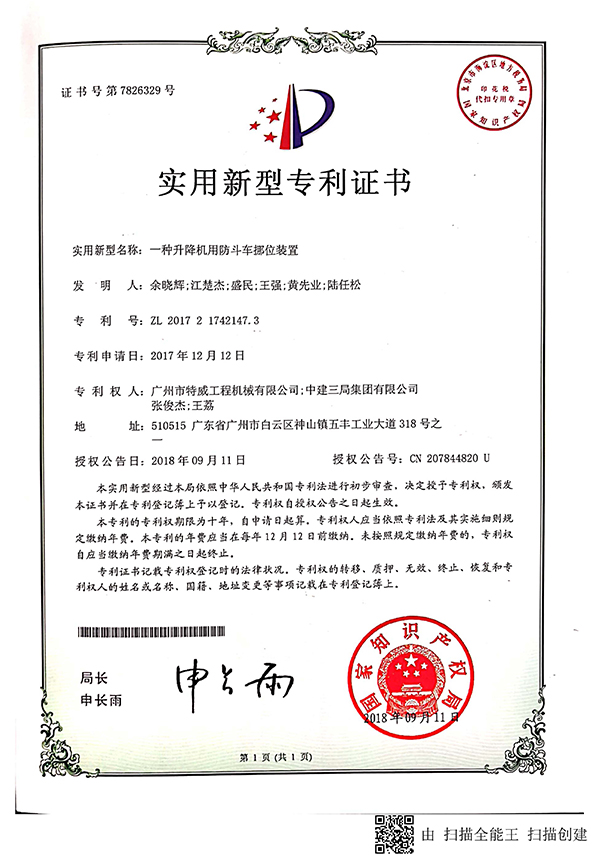

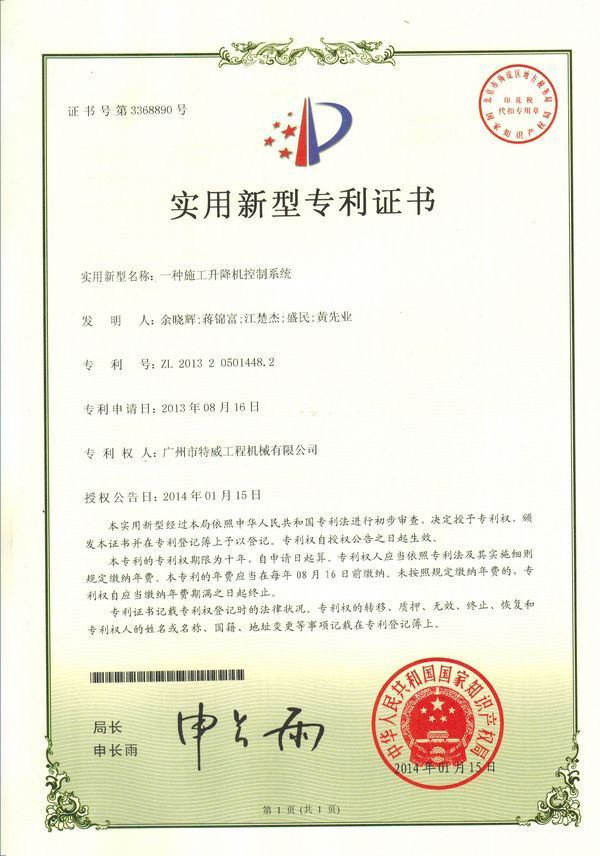

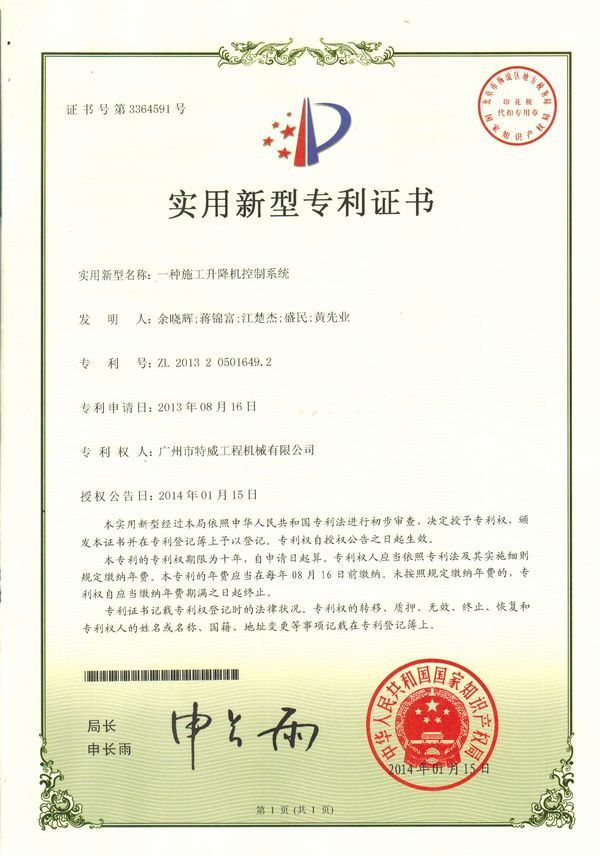

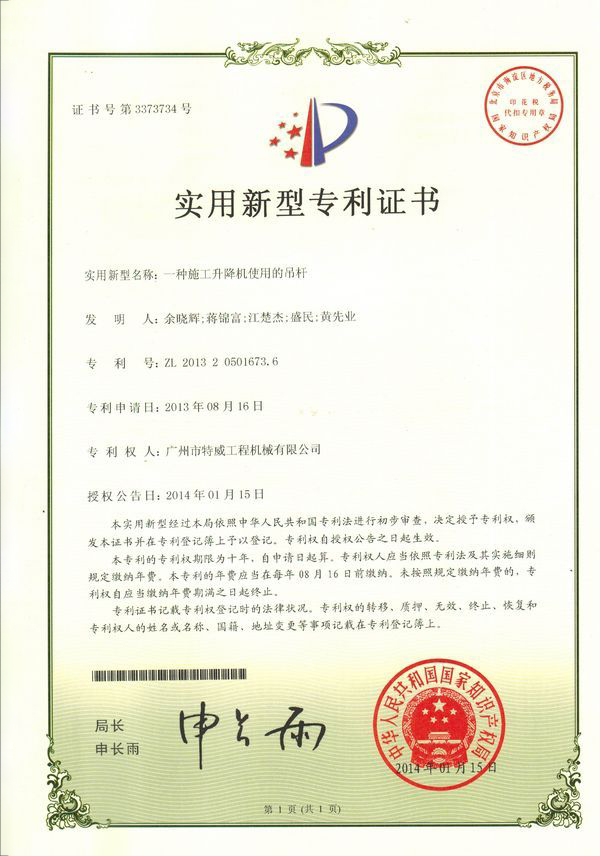

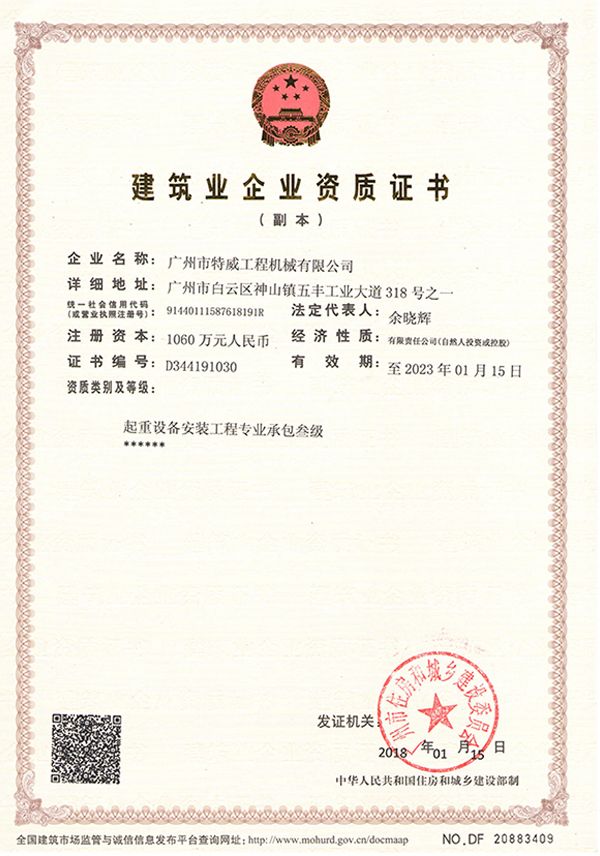

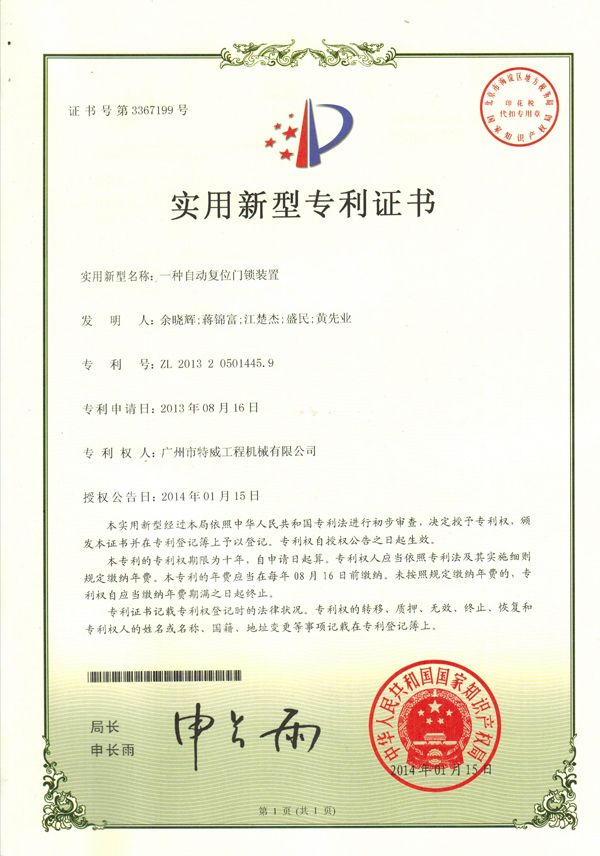

杏彩·电子(中国)官方网站地处广州市白云区神山镇,广清高速神山出口附近,是一家施工杏彩·电子(中国)官方网站的专业生产厂家。公司成立于2011年,占地100000多平方米,注册资金1060万元,现有员工300余人其中工程技术人员33人,高级技术人员52人。

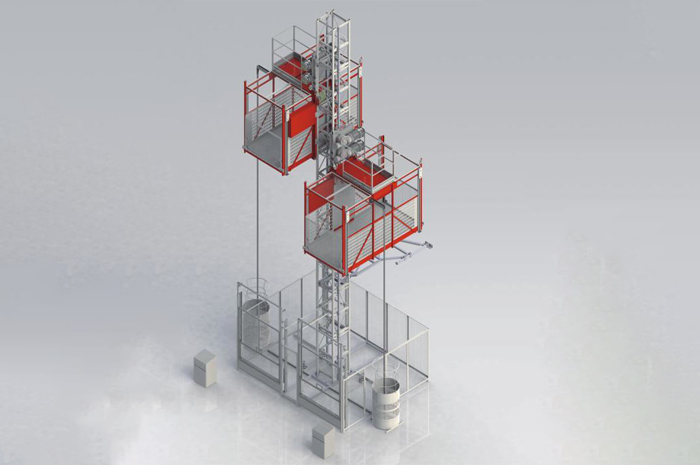

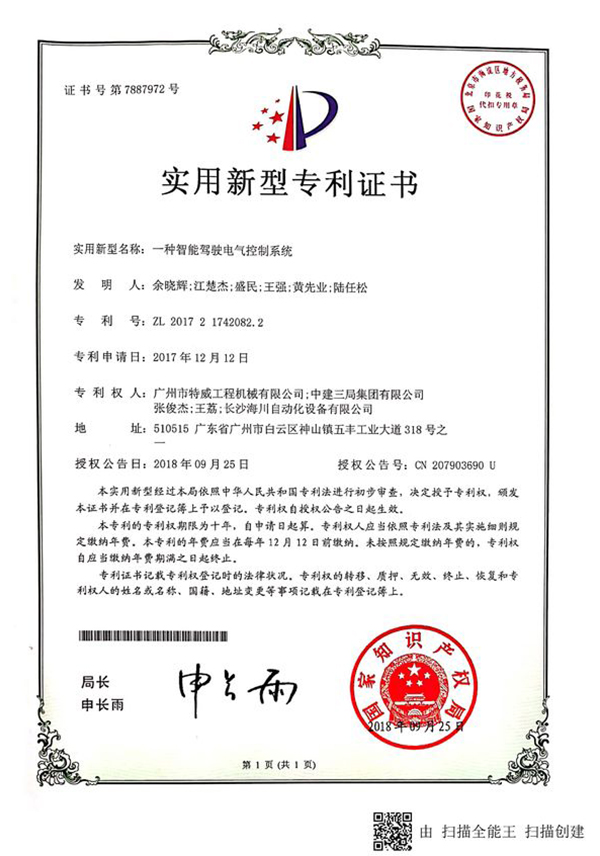

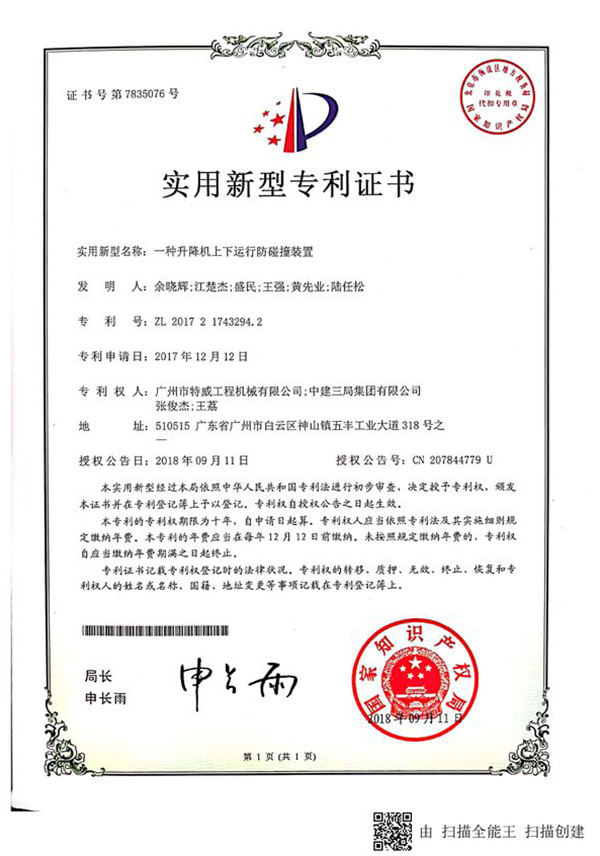

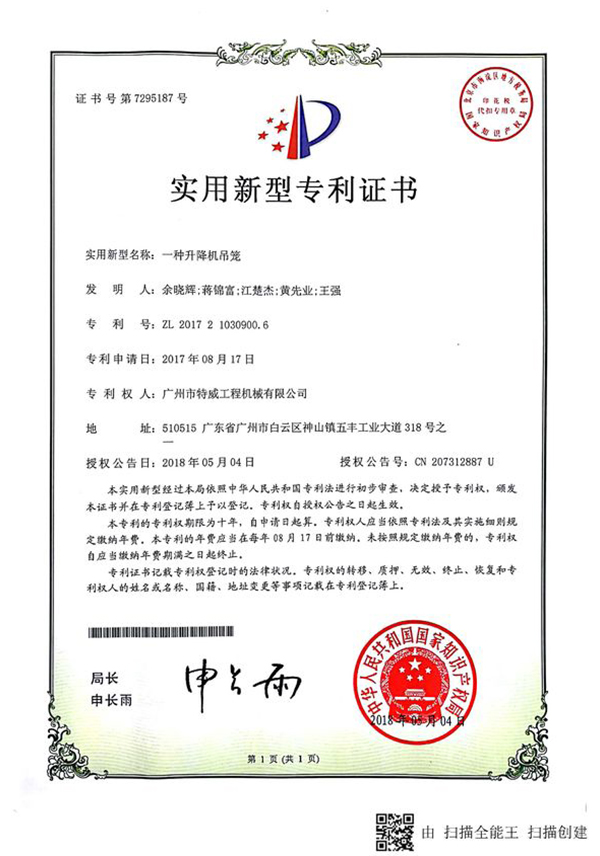

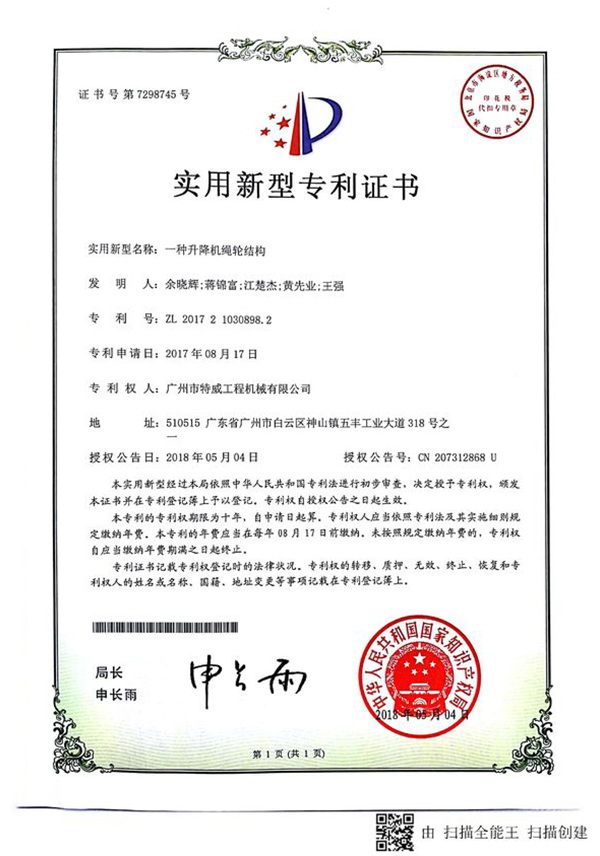

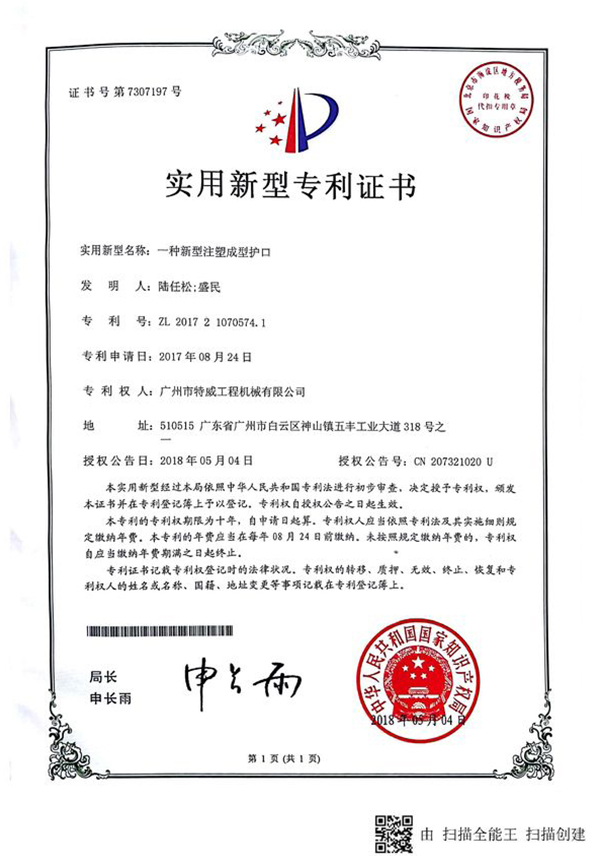

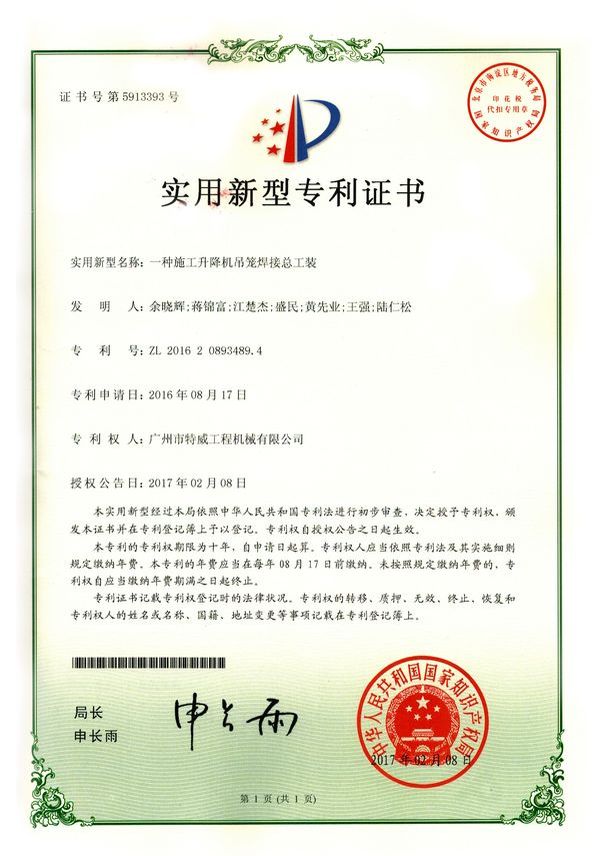

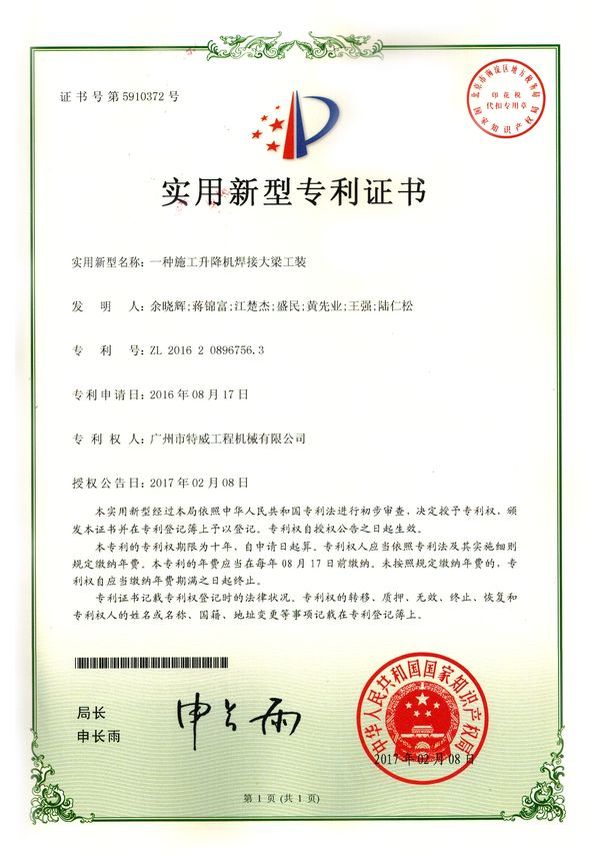

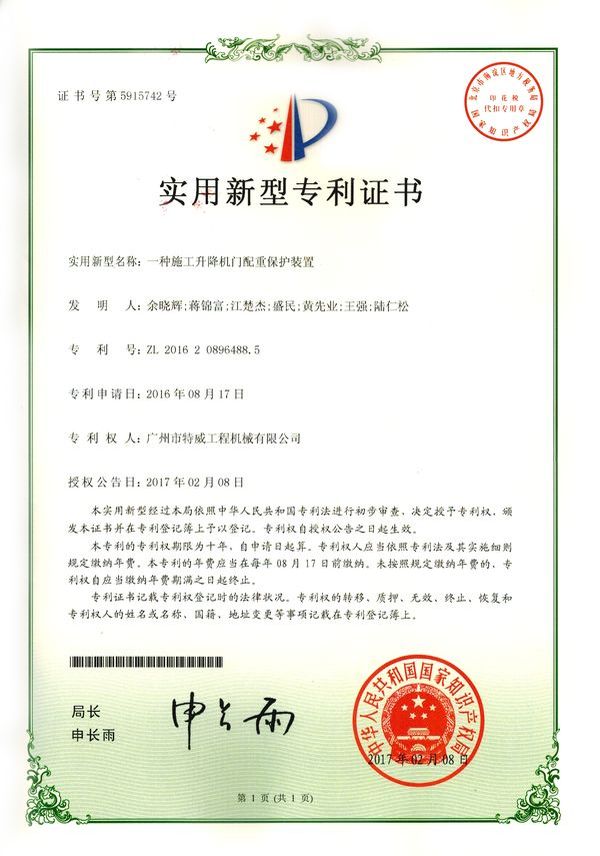

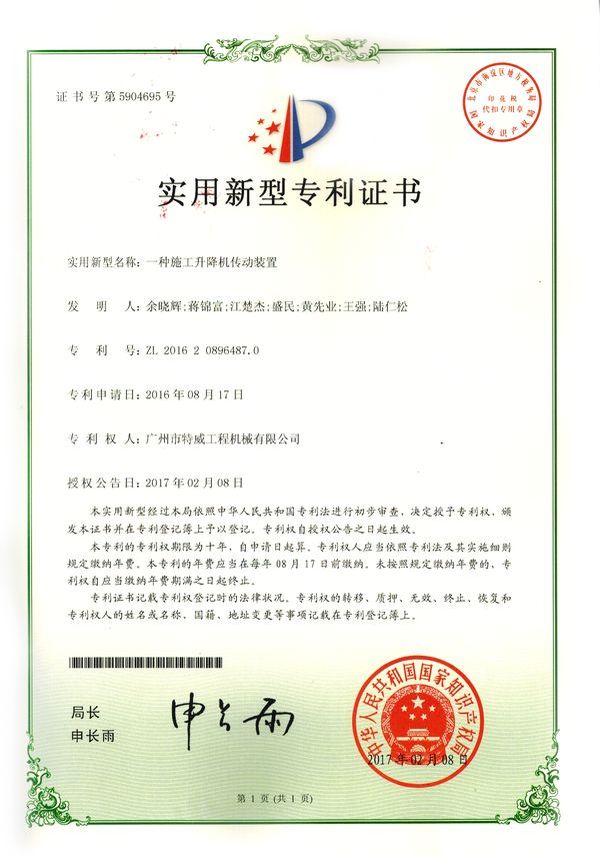

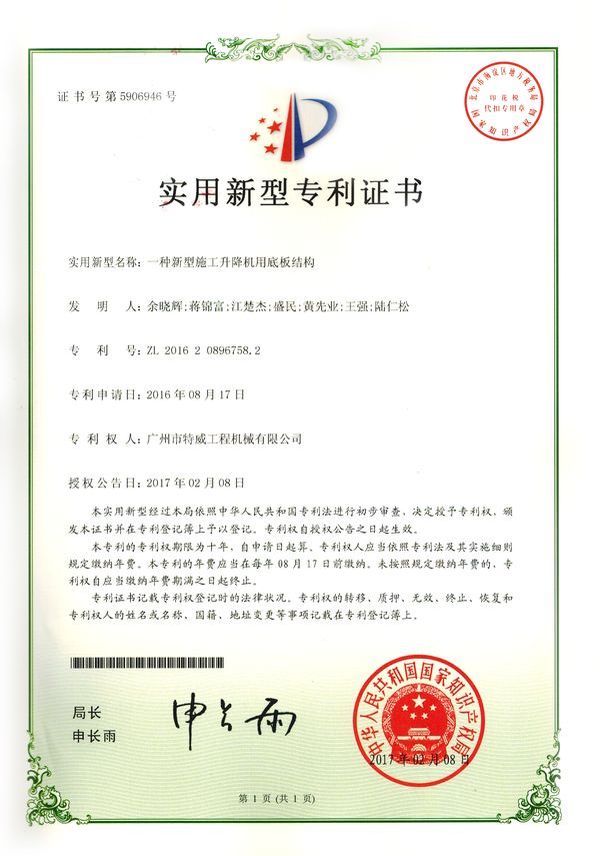

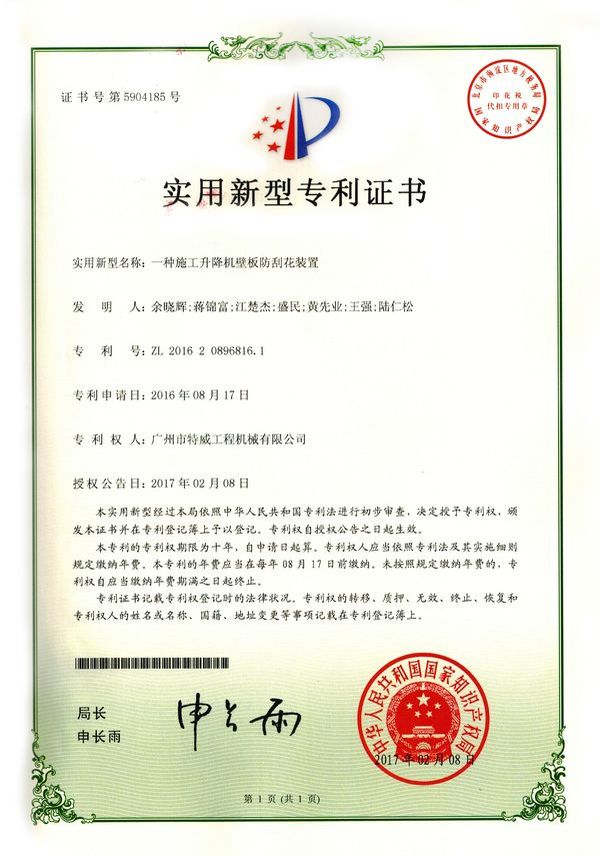

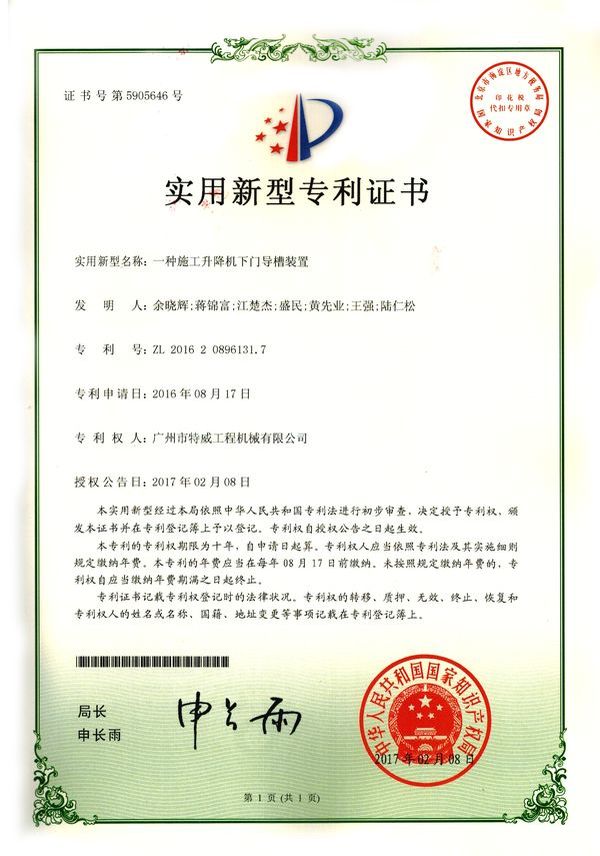

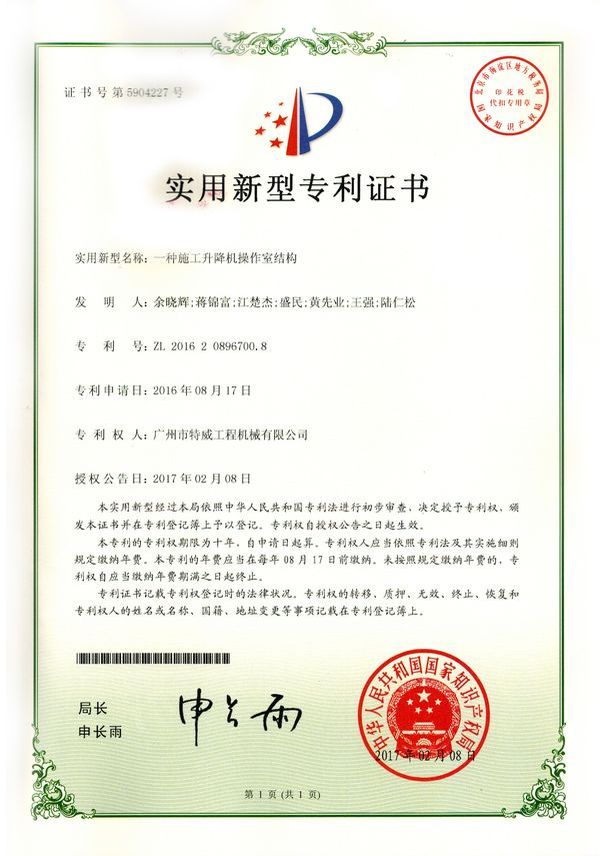

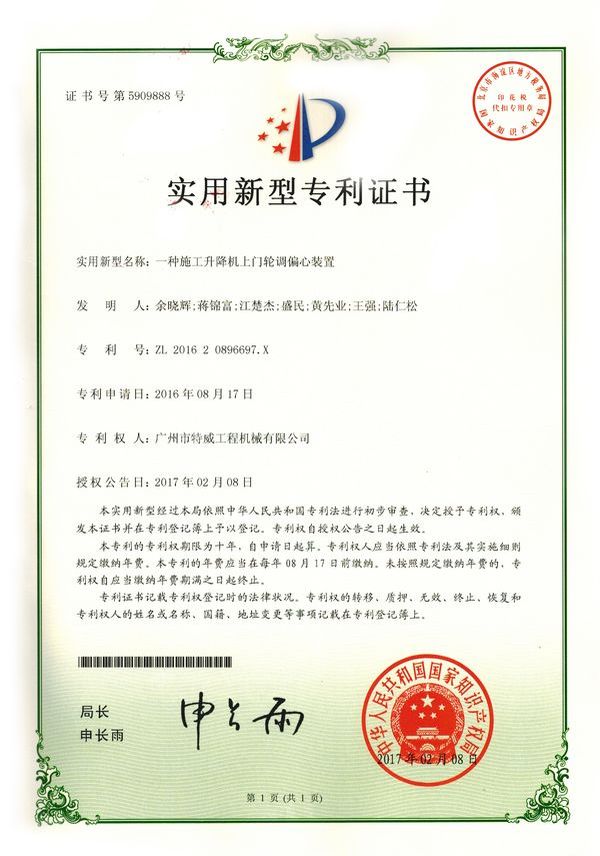

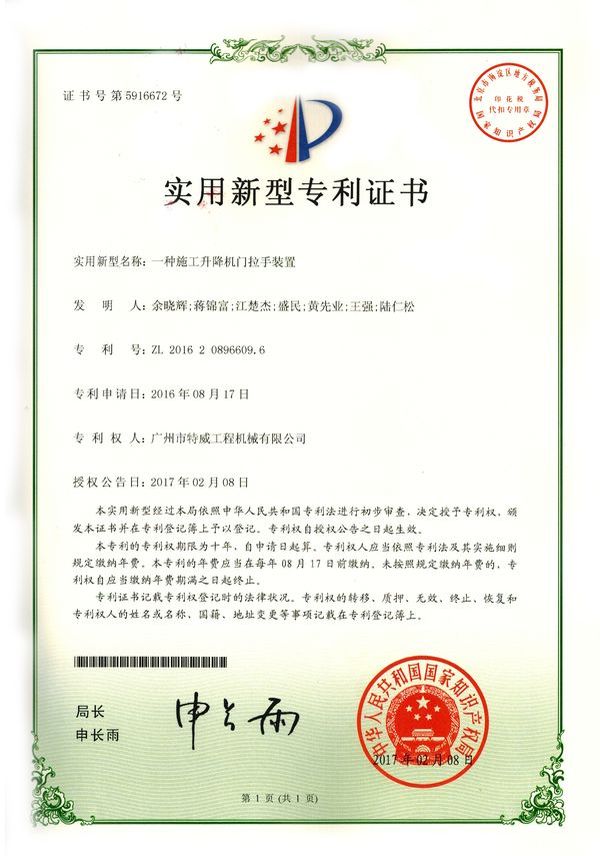

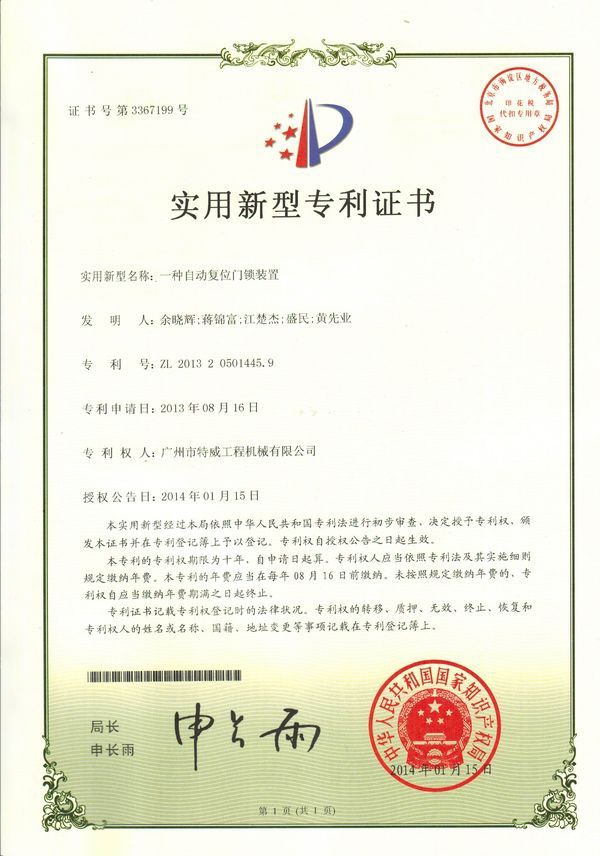

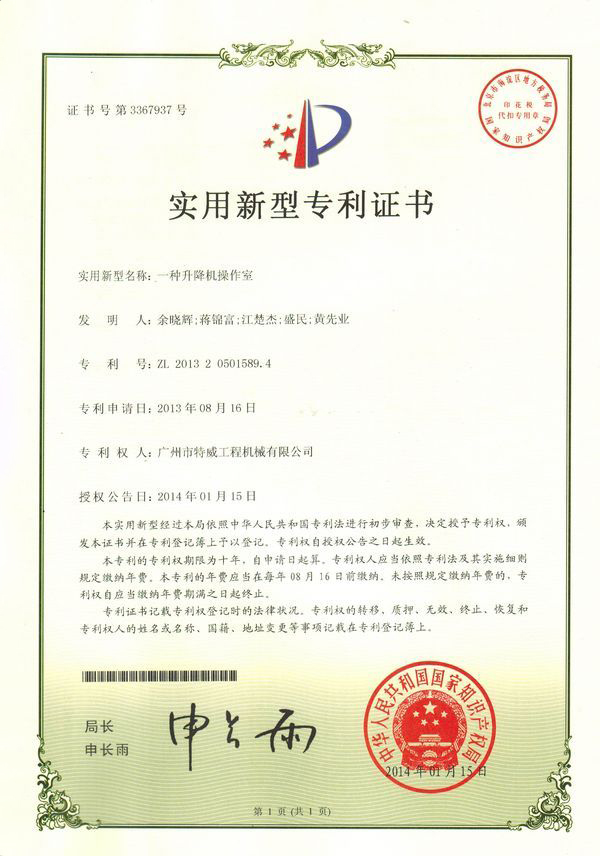

SC200/200G型施工杏彩·电子(中国)官方网站是杏彩·电子(中国)官方网站公司的主导产品,是一种靠齿轮齿条传动的电梯。具有广泛的用途,不仅可用于一般的高层建筑施工的人、货运输,还可用于工业、电力、矿井、石油、化工等领域的人货运输。整机的工作级别为A8。 公司产品严格执行行业标准并进行大量人性化处理,在吊笼内饰、电控箱、驾驶室等部位进行优化改进,使用起来更为方便、安全。